Welcome to the world of international trade! As a new importer in Singapore, you’re likely excited about the new products and opportunities you’re bringing to the market. But you’ve also probably encountered the more confusing side of logistics: customs paperwork. Of all the acronyms and codes, one is more critical than any other: the HS Code.

Getting this code right is the single most important step for a smooth, delay-free import. Getting it wrong can lead to costly fines, frustrating delays, and even seizure of your goods.

As Singapore’s trusted logistics partner, Global Lacis Logistics wants to demystify this process for you. This guide will break down exactly what HS codes are, why they matter, and how you can find the right one for your products.

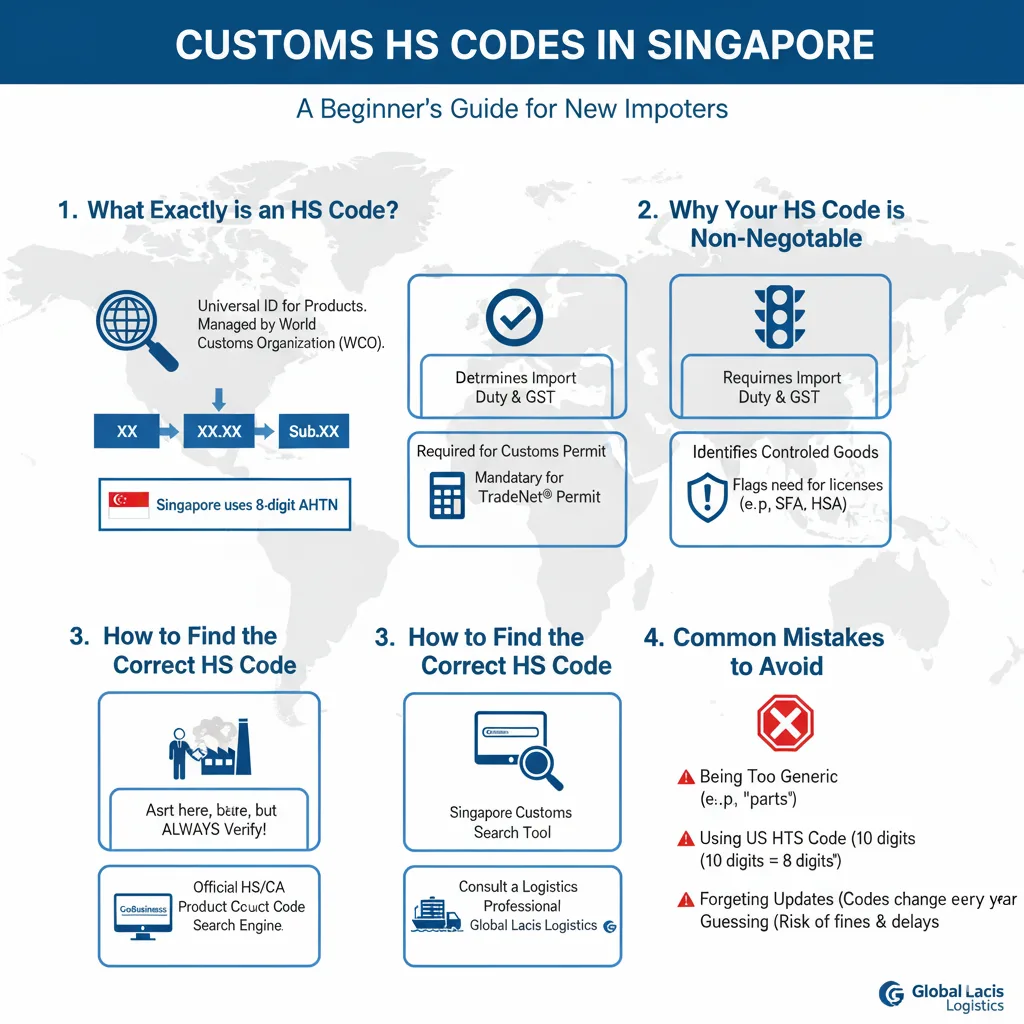

1. What Exactly is an HS Code?

Think of a Harmonised System (HS) Code as a universal ID or “zip code” for products.

It’s an international standard used by over 200 countries and economies to classify goods that are being traded. This system is managed by the World Customs Organisation (WCO) and ensures that customs authorities in Singapore, the USA, China, and Europe are all speaking the same “language” when they see your product.

The Structure of a Code

An HS code is a string of numbers. Here’s a simple breakdown:

First 6 digits:

This is the universal standard (the HS code). It’s the same in almost every country.

- Chapter (First 2 digits): The general category (e.g., Chapter 09 = “Coffee, Tea, Maté and Spices”).

- Heading (First 4 digits): A more specific product group (e.g., 09.01 = “Coffee…”).

- Subheading (First 6 digits): A more detailed description (e.g., 0901.11 = “Coffee, not roasted, not decaffeinated”).

Singapore’s Specific Code: The AHTN

While the first 6 digits are global, many countries add more digits for their own, more specific classifications.

In Singapore, we use the 8-digit ASEAN Harmonised Tariff Nomenclature (AHTN). This system is used by all 10 ASEAN member states to ensure uniformity across the region.

Key Takeaway: For importing into Singapore, you will need to find the correct 8-digit AHTN code for your product.

2. Why Your HS Code is Non-Negotiable

For new importers, it’s tempting to see the HS code as just another box to tick. In reality, it’s the key that unlocks the entire import process.

Here’s exactly what this 8-digit code controls:

Determines Your Duties and GST

This is the most important function. The HS code directly tells Singapore Customs what rate of import duty (if any) applies to your goods. Because Singapore is a free port, most goods are duty-free, but duties do apply to certain items like tobacco, liquor, motor vehicles, and petroleum products.

The code is also used to calculate the Goods and Services Tax (GST), which is payable on almost all imports.

Required for Your Customs Permit

You cannot legally import your goods without a customs permit, which is filed through the TradeNet® system. The HS code is a mandatory field on this permit application. An incorrect code can lead to your permit being rejected, delaying your entire shipment.

Identifies Controlled & Prohibited Goods

Does your product need a special license? The HS code holds the answer. To determine whether your goods are “controlled” by a Competent Authority (CA), Singapore Customs uses the code.

Example: Importing food products? Your HS code will flag the need for a licence from the Singapore Food Agency (SFA).

Example: Importing cosmetics? You’ll need approval from the Health Sciences Authority (HSA).

Using the wrong code could mean you unknowingly import a controlled item without a licence, a serious offence.

3. How to Find the Correct HS Code for Your Products

This is the most challenging part for beginners, but you have options.

Method 1: Ask Your Supplier (The Easy Start)

Your manufacturer or supplier is the best place to start. They likely ship their product globally and should know its 6-digit HS code.

⚠️ Word of Caution: Always verify the code your supplier gives you. They might provide a code from their own country (which might be 10 digits, like a US HTS code) or an incorrect one. The ultimate responsibility for the correct code lies with you, the importer.

Method 2: Use the Singapore Customs Search Tool

Singapore Customs provides a free, powerful tool to find your 8-digit AHTN code.

- Visit the official Singapore Customs website.

- Look for the “HS/CA Product Code Search Engine” (or the “HS/CA Product Code Checker” on GoBusiness).

- You can search by keyword (e.g., “wooden chair” or “laptop computer”) or browse the chapters.

- Be specific. Don’t just search for “shoe”. Is it a “leather shoe” (Chapter 64)? “A sports shoe” (6404)? “A waterproof shoe” (6401)? The more detail, the more accurate the code.

Method 3: Consult a Logistics Professional

Let’s be honest, HS code classification can be extremely complex. Is your product a “kit” with multiple components? Is it a “multi-function” device? The rules can be confusing, and the stakes are high.

An experienced customs broker or freight forwarder, like Global Lacis Logistics, handles this every day. We have the expertise to:

- Analyse your product’s materials, components, and intended use.

- Classify it according to the WCO’s General Interpretative Rules (GIRs).

- Ensure your 8-digit AHTN code is 100% accurate, saving you from fines and delays.

4. Common Mistakes to Avoid

Avoid these common pitfalls that we see new importers make:

- Being Too Generic: Classifying “smartwatch” parts as “spare parts” (a vague term) instead of their specific codes.

- Using a US HTS Code: A 10-digit US HTS code will be rejected by Singapore’s 8-digit TradeNet system.

- Forgetting About Updates: HS codes are revised by the WCO every 5 years to account for new technology. An old code may no longer be valid.

- Guessing: Never guess your HS code. The cost of a fine or a shipment held at the port is far greater than the time it takes to verify the code.

Don’t Let Customs Codes Be Your Bottleneck

Your HS code is the foundation of your import declaration. Getting it right ensures you pay the correct duties, secure the right licences, and get your goods into Singapore without a hitch.

While the system is complex, you don’t have to navigate it alone. At Global Lacis Logistics, our team of customs experts is here to provide the certainty and clarity you need. We’ll handle the complexities of HS code classification and customs clearance, so you can focus on what you do best: growing your business.

Ready to import with confidence? Contact Global Lacis Logistics today for a consultation on our seamless customs clearance services.